The following is an extended version of a piece that ran in the April 2019 edition of Long Island Living magazine. You can read the original here. Want to support The Foggiest Idea’s award-winning coverage of the issues that matter? Click here.

Experts say the new tax law will impact the region’s real estate market – but exactly how remains to be seen.

By Richard Murdocco

Homeowners in pricey areas like Long Island should prepare themselves for the potential of lower home values as new tax rules and regulations take effect. Despite a negative forecast by experts, exactly how and when Long Islanders will be affected remains fuzzy at best.

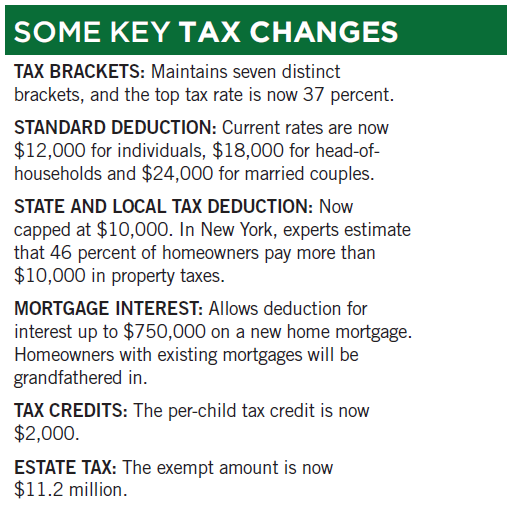

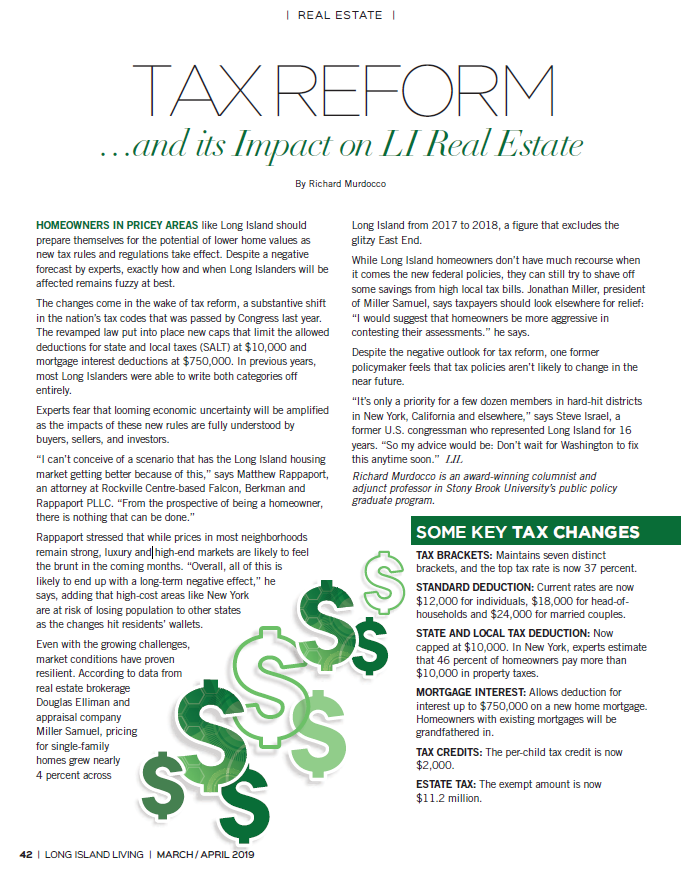

The changes come in the wake of tax reform, a substantive shift in the nation’s tax codes that was passed by congress last year. The revamped law put into place new caps that limit the allowed deductions for state and local taxes (SALT) at $10,000 and mortgage interest deductions at $750,000. In previous years, most Long Islanders were able to write both categories off entirely.

Experts fear that looming economic uncertainty will be amplified in high-cost areas like Long Island as the impacts of these new rules are fully understood by buyers, sellers, and investors.

“I can’t conceive of a scenario that has the Long Island housing market getting better because of this,” Matthew Rappaport, an attorney who specializes in domestic tax issues with Rockville Centre-based Falcon, Berkman and Rappaport PLLC, told Long Island Living. “From the prospective of being a homeowner, there is nothing that can be done.”

Rappaport stressed that while pricing in most neighborhoods remains strong, luxury and high-end markets are likely to feel the brunt in the coming months. “Overall, all of this is likely to end up with a long-term negative effect,” he said.

Even with the growing challenges, market conditions have proven resilient. According to data from real estate brokerage Douglas Elliman and appraisal company Miller Samuel, pricing for single-family homes has grown nearly 4% across Long Island from 2017 to 2018, a figure that excludes the glitzy East End.

As any homeowner would attest, living on Long Island isn’t exactly cheap.

In New York State, experts estimate that 46 percent of homeowners pay more than $10,000 in property taxes. Long Island is even worse. According to data cultivated from Irvine, California-based ATTOM Data Solutions, a firm that tracks property taxes across the country, the average Nassau County property tax bill in 2017 was $11,415, the fifth highest average nationwide. Suffolk was a relative bargain at $9,471. Both counties were well-above the national average of $3,399 for that year.

To Rappaport, high-cost areas like New York are at risk of losing population to other states as the changes hit resident wallets. “Look at the differential between what taxpayers in New York pay compared to areas without state income taxes like Florida, Texas or Nevada,” he noted. “It’s now a bigger difference than any point in modern history. It’s a more compelling environment to switch where you live than it’s ever been.”

While Long Island’s homeowners don’t have much recourse when it comes the new federal policies, locally they can still try to shave off some savings from those high local tax bills. “In this new post-tax law world, the homeowner is not only paying for their property taxes, but are now being penalized further because the $10,000 cap on the deduction for their taxes,” Jonathan Miller, president and CEO of Manhattan-based Miller Samuel Inc. said, suggesting that homeowners can find relief from other avenues. “I would suggest that homeowners be more aggressive in contesting their assessments,” he said.

Even with higher costs and lower property values, one former policymaker feels that the new tax policies aren’t likely to change in the near future.

“It’s only a priority for a few dozen members in hard-hit districts in New York, California, and elsewhere,” Steve Israel, a former U.S. congressman who represented a majority of Long Island’s north shore for 16 years, said. “So my advice would be don’t wait for Washington to fix this anytime soon.”

Richard Murdocco is an award-winning columnist and adjunct professor in Stony Brook University’s public policy graduate program.