The following was exclusively published by The Foggiest Idea on November 20, 2020. Interested in supporting The Foggiest Idea’s award-winning reporting and analysis? Click here.

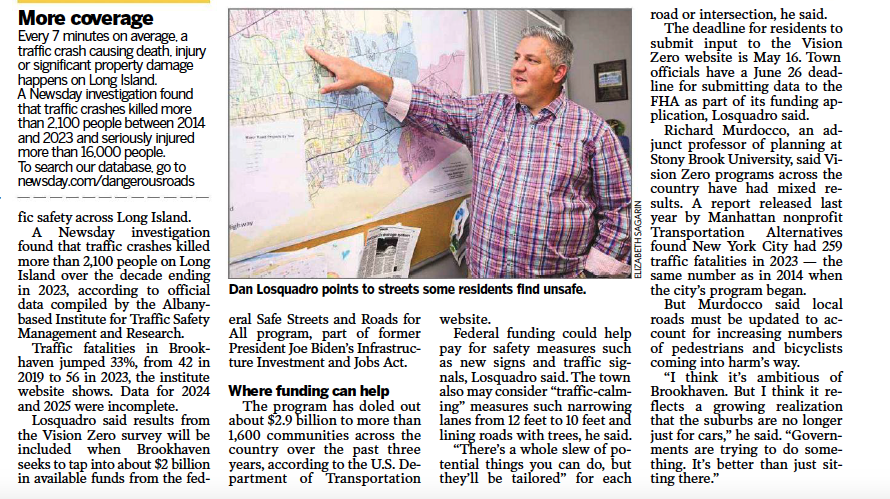

By Richard Murdocco

As millions in tax breaks continue to roll out, are Long Islanders (and the region as a whole) financially better off?

Whether from the high costs of energy or the heavy burden of commercial property taxes, conducting business in our region doesn’t come cheap.

New York elected officials constantly have to compete with their neighbors in other states to give their own localities an edge.

Over the years, our policymakers have increasingly turned to quasi-governmental public benefit corporations known as Industrial Development Agencies (IDAs) to boost productivity in a particular area and hopefully derive more long-term revenue from companies that choose to stay.

First introduced in 1969 under New York State law, IDAs were created to “facilitate economic development in specific localities, and delineate their powers and status as public benefit corporations.” Currently, the Empire State has 115 active IDAs, with at least one in each county, as well as in cities, villages and towns. Here on Long Island, Babylon, Brookhaven, Islip and Riverhead towns in Suffolk each have their own IDA, while in Nassau, Glen Cove and Hempstead Town have theirs too.

IDAs don’t run directly on taxpayer funds. Instead, their work is funded by fees generated by business applicants seeking to take advantage of the IDAs’ benefits.

Opponents regard their local IDA as representing everything they hate about local governance here. To them, these agencies are yet another way political insiders can reward their friends by fleecing the taxpayers.

Proponents of IDAs say the collective economic wisdom of having these agencies is beyond question. Without them, growth would grind to a halt across the region. So, these advocates say, taxpayers should just be grateful these agencies exist and let them be.

The IDAs’ advocates don’t like being misunderstood, while the adversaries hate seeing IDAs hand out tax breaks that apparently generate little to no payoff.

When an IDA’s pending deals are especially tenuous, the public discourse can be as heated as it gets on Long Island.

“IDA’s are the most misunderstood, vilified, and politically weaponized economic incentive programs on Long Island,” said Dr. Thomas Conoscenti, a longtime economic consultant from Nesconset, in the pages of Long Island Business News back in February.

That view was not shared by one concerned Nassau resident who saw the agency quite differently.

“IDA is a smoke and mirror. Developers getting huge tax breaks while property owners continue to pay high taxes,” posted Alan Pawelsky, a plumber from Lynbrook, to his peers in a Facebook group that claims to fight over-development throughout Nassau County. “Politicians getting campaign donations from these developers. Meanwhile, Nassau County becoming Queens east.”

In a recent Newsday op-ed, Kyle Strober, executive director of the Association for a Better Long Island, which represents commercial landlords and other large businesses, and Mitch Pally, chief executive officer of the pro-development Long Island Builders Institute, argued that “the role of the IDA continues to be demonized by those who are ideologically opposed, but the main objections come from those who misunderstand how the deals work.”

To Strober and Pally, the role of an IDA is straightforward enough: to encourage developers to come to Nassau and Suffolk Counties by dangling fiscal carrots to hedge their investment risk.

Pictured: Mitch Pally, CEO of LIBI, and Kyle Strober, head of ABLI, as seen in 2019. Both Pally and Strober frequently team up to press elected officials and policymakers on economic and developmental issues. (Photo Credit: Long Island Business News)

“The truth is Long Island’s real estate taxes, compounded by local zoning density restrictions, very often make or break the financing structure,” said Strober and Pally, adding that “IDA PILOT programs come close to leveling the financial playing field.” PILOTs (Payment in Lieu of Taxes) are the partial taxes paid each year by companies receiving aid from their local IDA.

Paul Sabatino, a former chief deputy Suffolk County executive, a longtime former Suffolk legislative counsel, and still-practicing attorney, laughed out loud when The Foggiest Idea read him excerpts of Strober and Pally’s Newsday op-ed piece that ran on Oct. 8, 2020.

“It’s demonstrably absurd to say that IDAs level the playing field,” he told TFI in between his laughter. “The small deli owners and other small business owners who come into my office have zero chance of getting an IDA break.”

As Sabatino sees it, a business owner has to know the right insiders to profit from what the IDAs have to offer.

“To the extent they think they’re leveling the field it’s the opposite,” he stated, less jovially. “IDAs favor the politically connected and larger firms.”

Some IDA deals have drawn plenty of flak once their details come to light.

In 2014, Nassau County’s IDA argued that a gym locker could constitute a “landlord-tenant relationship” so it could shower an incoming Life Time Fitness in Garden City with tax breaks. That same year, the same IDA claimed that a Costco coming to Oceanside was actually a “tourist destination” so the developers could secure tax savings.

Public outcry squashed the Costco deal, but Life Time’s proposal proved more successful, with Nassau IDA officials approving a 20-year PILOT package and authorizing up to $2 million in savings on sales taxes. Perhaps due to the negative publicity, Life Time eventually turned down the IDA’s support.

A few years earlier, the local IDA in the Town of Babylon had used the same dubious “tourist destination” designation to give the Tanger outlet mall in Deer Park a break. Developers received a 60% tax cut, which the town’s IDA subsequently extended and made even more generous just as the original deal was about to sunset.

The public’s ire on the subject came to a head when the Hempstead IDA gave a series of controversial tax breaks to the Green Acres shopping mall and an adjacent shopping center in Valley Stream in 2015. That deal was worth $6 million per year for a 10-year period. Afterwards, property tax bills skyrocketed nearby because the local school district had miscalculated the financial impacts of the IDA’s mall deal. Some residents saw their tax increase by nearly $800.

Pictured: The Green Acres Mall in Valley Stream. In 2015, the property underwent nearly $163 million in renovations and additions. The investment in the property was supported by various tax breaks and other incentives worth millions of dollars over a ten-year period. (Photo Credit: Macerich Properties)

As a result of the outcry, Hempstead’s IDA tried to yank back the PILOTs they’d issued, but their revocation was ultimately rebuffed by the Nassau County Supreme Court in 2018 when the court sided with the mall owners. The fallout was felt at the ballot box though. The debacle was considered as a contributing factor that helped to turn Hempstead, a longtime Republican stronghold, blue later that year with the election of Democrat Laura Gillen as Town Supervisor. She was the town’s first Democratic supervisor in over a hundred years.

After the dust finally settled in Valley Stream, the New York State Senate’s Committee on Investigations and Government Operations agreed with the state Comptroller’s findings in 2019 that although the school district was principally to blame for the local tax hikes, the overall scenario “demonstrates the need for all IDAs to properly and systematically track verifiable employment data on its own — and not be subject to the whims of an applicant’s, or it’s vendors’ reporting.”

New York State now requires all IDAs to offer notice about their upcoming meetings and livestream them to the public. Suffolk County took it a step further by passing legislation that directed relevant county departments to assess the effectiveness of economic development initiatives.

“IDA activity has always been reported in the media, but the Green Acres Mall incident, which again was misunderstood and politicized, brought their actions to the front of the newspaper and out of the business section,” Strober told TFI. “It’s important to note, in the end, the comptroller deemed the school district was at fault, not the IDA.”

Today, the tax breaks are still rolling out.

Despite a raging pandemic that has left municipal coffers reeling, the Nassau IDA granted a mostly empty office building in Carle Place a series of cascading benefits in July of this year.

The deal includes more than $672,000 in sales tax exemptions on the purchase of construction materials and furnishing, up to $97,500 off the property’s mortgage recording tax, and a 20-year reduction in property taxes that freezes the site’s tax rate for six years followed by subsequently incremental increases. Collectively, the tax breaks are supposed to support nearly $14 million in proposed renovations to modernize the property and halt the exodus of tenants from the building. By next year, the building is expected to be 66% vacant. The Nassau IDA did not respond to a request for comment by TFI.

“My concern is whether we’re going to get into the habit of giving tax benefits to every single building that has large empty office space to help them attract tenants,” said Timothy Williams, a former Nassau IDA chairman who is now the group’s secretary, during the IDA meeting on the proposal.

“If that’s the case,” he added, “we’re going to have benefit packages going to hundreds of office buildings.” Williams cast the lone dissenting vote on the deal. His colleagues gave their unwavering approval.

Pictured: Attorney Paul Sabatino with then-Suffolk County Executive Steve Levy, as seen in 2007. Sabatino, a longtime critic of IDAs, once told TFI that the agencies are “the poster child for crony capitalism.” (Photo Source: Kirk Condyles/ The New York Times)

A month later in Long Beach, the Nassau County IDA agreed to grant $49 million in tax incentives over a 25-year period for a luxury oceanfront apartment and condo complex on the long-idle Superblock parcel. Further east, Suffolk County’s IDA approved 15 years of tax incentives totaling $3.1 million for a hotel planned for Huntington’s old town hall. Altogether, $2.3 million of those dollars are tallied from a reduction in property taxes, with the difference coming from sales-tax and mortgage-recording tax deductions.

Both deals raised questions about why the developers of these two high-end projects couldn’t afford to pay their own fair share of taxes.

Newsday’s editorial board didn’t mince words. “There seem to be only two possible answers: either the tax system is broken or the IDA breaks are unjustified,” they wrote, calling the presence of eight IDAs in our region “unwieldy.”

For municipalities and school districts that rely on a robust commercial tax base to balance their budgets, the stakes couldn’t be higher. When IDAs secure tax savings for periods up to 40 years, the tax reductions can reach as much as 90 percent—and that lost revenue can really hurt their bottom line.

Even more problematic, the tax breaks doled out by IDAs over the years have a checkered record of actually retaining businesses on Long Island. The examples are telling. OSI Pharmaceuticals, Goya Foods, Arrow Electronics and Symbol Technologies are just a few of the more than 30 corporations that the Island has lost in some form since 2003.

As the companies leave, the price of attracting and keeping other businesses here continues to escalate. According to a 2018 Newsday report, the annual cost of these IDA tax breaks awarded to Long Island companies had tripled to more than $140 million since 2004.

When IDAs were studied in detail by New York State Comptroller Tom DiNapoli’s office, his researchers found vast disparities in their cost-effectiveness depending on the locality in question. While Suffolk County’s IDA granted $756 in tax breaks for every job gained, Nassau’s IDA granted $4,163 in tax breaks per job generated in 2017.

Those figures represented a marked improvement from 2013, when Nassau was spending $23,611 per new employee position created. Today, only the City of Glen Cove’s IDA is close to matching that exorbitant formula, with its IDA giving a net of $23,978 in exemptions. But the Town of Hempstead isn’t much better with its $11,743.

Pictured: The Long Beach “Superblock,” a six-acre ocean-front site that has been vacant for decades. The property sits between Long Beach Boulevard and Riverside Boulevard in the City of Long Beach. (Photo Source: Google Maps)

To ABLI’s Strober, these expenditures and reductions are much needed to attract new private investment in such an expensive region.

“Until Long Island addresses a tax system that is unsustainable and a local zoning system that is suffocating, IDAs will continue to be a critical tool needed to lure investment and jobs to our region,” Strober told TFI. “Unfortunately, this vital role played by the IDAs continues to be maligned and totally misunderstood.”

To Strober, any calls to disband the IDA model are misguided.

“Transparency is important in all facets of government, including IDAs,” Strober said. “But the desire for more transparency does not mean abolishment.”

By contrast, Sabatino believes that having so many IDAs dispensing tax breaks in our region makes it impossible to enact cohesive and responsible economic policies here.

“When you have competing IDAs, all you’re doing is cannibalizing,” Sabatino said.

But, as he points out, the IDAs aren’t set up to address the broader economic issues that make it rougher for companies to conduct business on Long Island rather than someplace else.

“Generally speaking, how serious are those threats when companies say they’re leaving for areas with lower taxes or less regulations?” Sabatino said. “If they are serious, it’s based on bad budgetary or tax policies. All the IDAs wind up doing is papering over the underlying causes, and that says to me that maybe we should address those problems.”

And when it comes to regional policy making, it’s clear that IDAs alone won’t get the job done.

Richard Murdocco is an award-winning columnist and adjunct professor in Stony Brook University’s public policy graduate program. He regularly writes and speaks about Long Island’s real estate development issues. Follow him on Twitter @thefoggiestidea. You can email Murdocco at Rich@TheFoggiestIdea.org.

This year, TFI celebrates ten years of #SoundPlanning. Learn more here.

I call the IDA’s the Long Island Mofia. I agree with everything Sabatino stated in this article. “IDAs favor the politically connected and larger firms.” And these deals that are made have been done in back rooms with the doors closed. The tax breaks some corporations receive are just shy of obscenities. Citizen review boards are needed. Expose the bastards. And give the smaller businesses a fair and equitable shake. Better yet, get rid of the IDA. Over development is crushing suburbia and the rich get richer and the Mom & Pop’s are shuttering their doors, forever.