The following was published exclusively on The Foggiest Idea on October 28, 2018.

Want to join The Foggiest Idea’s growing team of sponsors? Click here.

With annual end-over-end growth picking up the pace, we could soon see a correction.

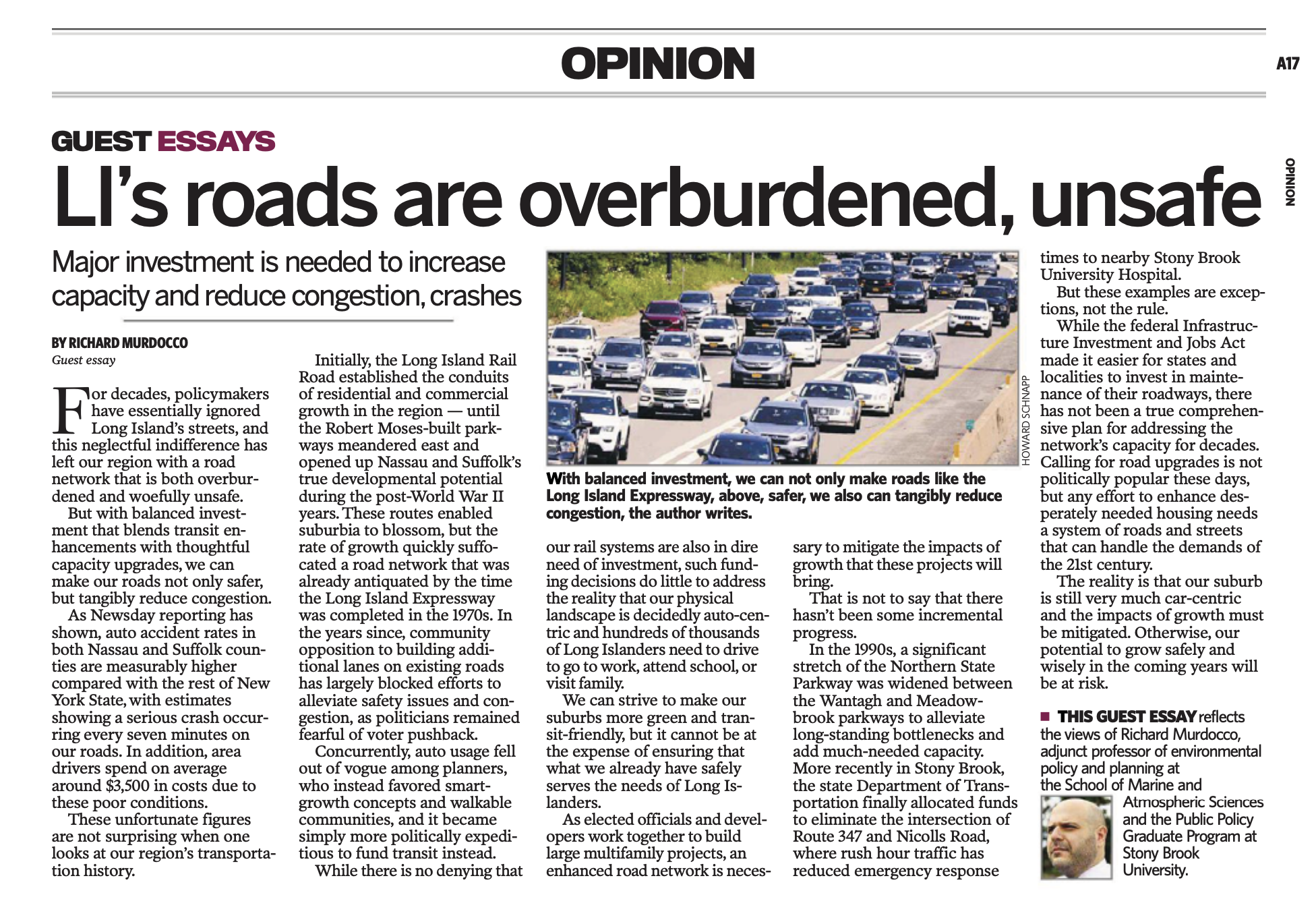

By Richard Murdocco

Across our region, the prices of single-family residences have steadily increased year after year, with those in Nassau and Suffolk neighborhoods west of NYS Route 110 rising the most.

In the short-term the forecast for sellers is rosy, but the market’s long-term prospects are more nebulous. Experts say things are not exactly picturesque out there, while others believe the strength of the bull market will win out.

“I don’t think there will be a correction,” Ann Conroy, president of the Long Island division of Douglas Elliman, told The Foggiest Idea. “While prices have dropped in luxury segments, the first-time home markets never appreciated like they did during the bubble-days, so they aren’t as vulnerable.”

To Conroy, the concern is not as much about the region’s accelerated pricing growth suddenly bursting, but rather the impact of higher interest rates and the specter of federal tax law reform limiting New York State’s deductibility.

“We’re just now starting to focus on interest rates, which can slow the appreciation,” she said. “We’re watching the tax burdens. For first-time homebuyers, it isn’t a problem, but it could be.”

Maybe it is now. In September, rising mortgage rates and an increase in supply slowed down home sales around Suffolk and Nassau, according to Long Island Business News. There were 2,361 homes contracted for sale, down from the 2,489 during the same period last year. Brokers have said the downturn is due to weakening demand and climbing interest rates. Overall, 12,725 homes were listed for sale as of Oct. 8. That’s 5.2 percent more than the number of homes listed at the end of September 2017.

“Pricing is experiencing a ‘slow grind’ as opposed to a ‘moment’,” said Jonathan Miller, president and CEO of Manhattan-based Miller Samuel Inc., a real estate appraisal and consulting firm that produces Douglas Elliman’s reports. Miller told TFI he believes that the market will eventually reevaluate what value truly is.

According to Miller, most economists are expecting a recession by 2020. Miller said that the real economic wild card for the real estate market is the related impacts from tariff policies and federal tax reform. “The Northeast is the most vulnerable to the new tax law, especially areas of New York State like Westchester, Nassau and Suffolk counties,” he observed. “These areas are the most exposed because doubling the standard deduction doesn’t come close to write-offs many property owners took for granted.”

The new law is looming large over the housing sector. “Overall, things are not quite tangible yet,” Miller said.

Until they are, other variables are influencing the market. For now, Conroy thinks the link between housing and job performance is protecting the sector.

“Housing is still going strong, but if the job market changes, we’ll see a major stall,” she noted. “Right now, everything is going along.”

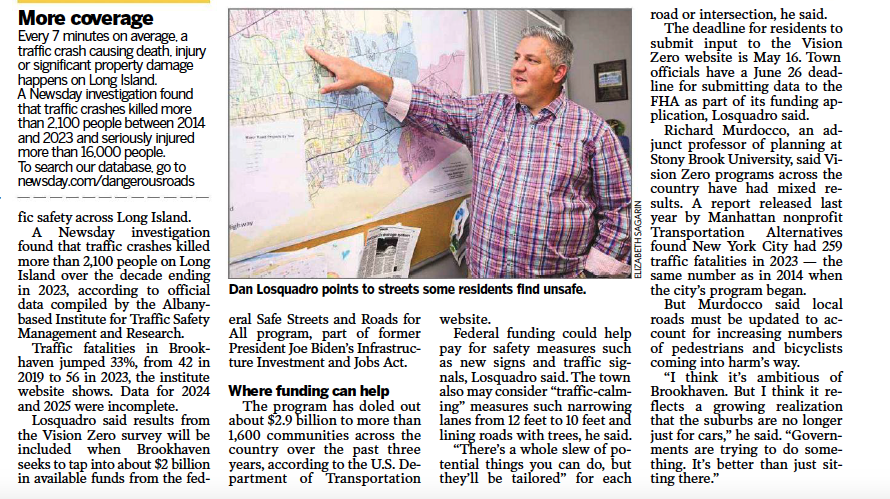

According to Stephen Checca, a licensed associate broker with Charles Rutenberg who has over a decade of experience selling in and around Nassau County’s Gold Coast, housing costs on Long Island are driven by buyers demanding to benefit from living in prominent school districts. Checca noted that cost gains are also being further fueled both by ambitious builders and well-heeled buyers from the boroughs looking for a slice of suburban life.

Checca described multiple instances of builders’ purchasing a modest 1,100 square foot ranch or cape-style house that sat on a 75 ‘ by 100 ‘ lot for $460,000 or so in Nassau County. From there, the firms take action: demolishing the structure to make way for the construction of a 3,000-plus square-foot luxury home typically valued at $900,000 to million dollars. “The sweet spot seems to be around 3,000 square feet, and builders know that since the Town of Oyster Bay typically allows for 25% lot coverage, they can simply build up while staying within the guidelines,” he noted, citing how many developments had pre-drafted plans to streamline the process further.

A newly-built home in Plainview, constructed on the site of a smaller house. The home sold for $988,000 in September 2018. (Photo via MLSLI).

“Most of the older houses have not been updated,” he said. The only real value in preserving the more modest structures is to keep the tax burden at bay. “It’s far easier for builders to have a clean canvas,” he added.

But new construction could impact pricing down the road. “I do believe we will level out,” Checca told TFI, echoing the market’s response to the still-unknown impact of taxes as Conroy and Miller had observed. “The new tax law hasn’t hit the buyer quite yet,” Checca said. “In April, you’re likely to hear people talk more about the tax burden, especially when new construction can have taxes over $20,000.”

What does this trend mean for affordability and young families trying to enter communities that were once predominantly middle-class?

Checca was to the point. “It’s difficult,” he said. “Most buyers who are coming out start in Manhattan, saw their investment appreciate, and now come into Nassau County with the means of making a 25% down payment on homes within the $900,000 to $1 million range.

“Asian buyers,” he continued, “especially those who owned properties in Bayside or Flushing markets, have seen market values skyrocket and now have the means of entry into these areas.”

To Conroy, the tear-down-build-up approach isn’t all bad.

“In a strong job market, buyers will find ways to get into their first home and eventually move up,” she said. “I think I see that more in the Hamptons, but most people embrace it because it adds value. Overall, I don’t think it hurts but helps.”

Miller warned that pricing isn’t always the economic bell weather it’s made out to be for predicting which way the wind is blowing in the housing market.

“Really, you have to look at sales volume,” he told TFI, noting that sales levels reflect a broader economic picture. “A lower sales level means that there is a disconnect between sellers and buyers,” he explained. “Often, sales trends tend to lead price direction by roughly six months or so, and prices reflect what happened after the dust settles. But there are lots of other variables.”

The question is, will Long Island’s housing sector have the resiliency to weather a coming economic storm?

Richard Murdocco is an award-winning columnist and adjunct professor in Stony Brook University’s public policy graduate program. He regularly writes and speaks about Long Island’s real estate development issues. More of his views can be found on thefoggiestidea.org or follow him on Twitter @thefoggiestidea. You can email Murdocco at Rich@TheFoggiestIdea.org.