The following was exclusively published by The Foggiest Idea on January 13th, 2023. Interested in supporting The Foggiest Idea’s award-winning reporting and analysis? Click here.

BY RICHARD MURDOCCO

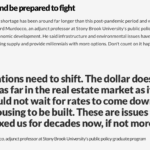

If Las Vegas Sands gets its way, the site of the Nassau Coliseum would become the epicenter of casino gambling in the downstate region.

The high-stakes project is expected to cost more than $4 billion. But the Paradise, Nevada-based casino conglomerate, known more for running its high-stakes games of roulette than for operating in areas with quiet suburban sidewalks, is expected to pick up the tab exclusively. Sands’ privately financed proposal includes a five-star hotel, a spa, community open spaces, as well as a nebulous indoor arena that the company is calling “a world-class live performance venue honoring the long legacy of live music at the Nassau Coliseum.”

The lease deal for Las Vegas Sands awaits final approval by the 19-member Nassau County Legislature.

Judging by the organizations it’s already brought on board—from John Durso of the Long Island Federation of Labor to Adrienne Esposito of Citizens Campaign for the Environment and Luis Vasquez of the Long Island Hispanic Chamber of Commerce—the odds may be in Sands’ favor. But is bringing Las Vegas-style table gaming to our region, which once engineered the technology that put men on the moon and pioneered the groundbreaking scientific like the MRI, the best we can do?

Have we gone so low in our suburban slump that our only aspirations for the Nassau Hub are for it to become the next Atlantic City? Once upon a time that Jersey Shore community bet its own future on gaming, only to sink into the economic doldrums where it remains today.

Now it’s Nassau County’s turn to spin the wheel. According to the developers, everything will be coming up aces.

Pictured: A rendering of Las Vegas Sands’ proposed casino at site of the Nassau Coliseum in Uniondale. (Source: Las Vegas Sands)

“We strongly believe Long Island can be home to one of the region’s great entertainment and hospitality developments,” Robert G. Goldstein, chairman and CEO of Las Vegas Sands said in a release. “Our ability to put forward a compelling and competitive proposal will only succeed if we engage with the Long Island community and, in collaboration, develop a proposal that reflects the input of all those involved.”

Interestingly, the public materials released by Las Vegas Sands does not explain how exactly the beleaguered Nassau Coliseum, which underwent an 18-month, $180 million renovation in 2018, will fit into their proposed casino/hospitality/venue mix. Preliminary renderings released so far by Las Vegas Sands don’t even show the Coliseum.

Like most significant developments these days, Las Vegas Sands’ proposal was first seen by the majority of Long Islanders either on the front page of Newsday or through social media, yet rumblings that a casino could come to Uniondale have already been percolating as New York State mulls issuing three full-blown casino licenses downstate. Yes, New York currently allows electronic gaming at sites like Jake’s 58 in Islandia, but these new licenses, slated for issuance sooner rather than later, would permit full-Vegas style venues – for better or worse.

To those paying attention recently, the latest news wasn’t surprising in the least.

In December, Las Vegas Sands was sniffing around the Nassau/Suffolk region, with the company hosting a two-hour joint meeting on the subject with the Nassau Council of Chambers of Commerce and the Suffolk County Alliance of Chambers in South Farmingdale.

At that presentation, former New York Governor David A. Paterson, who has since become a senior vice president at the casino developer, noted that Long Island’s proximity to LaGuardia and Kennedy Airports makes the area attractive for casino development.

The hedging of bets didn’t stop there. According to Newsday’s The Point, Las Vegas Sands has been busy since the New Year lining up a who’s who of local civic, business and labor leaders and having them tout just how excited they are for table games and a luxury hotel to come to the Hub.

Despite the PR blitz and the splashy announcements, the fact remains that the subject of casinos and their broader implications for economic growth have been studied time and time again—and the conclusion remains that gaming isn’t the financial golden goose all these developers claim it to be.

As Thomas Garrett, a former research economist who went on to become a professor at the University of Mississippi, noted in a 2003 research article for the St. Louis Federal Reserve, “…the degree to which the introduction and growth of commercial casinos in an area leads to increased economic development remains unclear.”

Adam Scavette, the regional economist at the Federal Reserve Bank of Richmond, found that casino density also impacts economic returns. “As the means to gamble proliferate and gambling-restricted states dwindle, commercial casino expansion is less likely to induce economic growth,” he wrote in July 2022.

Pictured: Another view of the proposed casino and luxury hotel development being pitched for the Nassau Coliseum site. (Credit: Las Vegas Sands)

And Uniondale isn’t the only place in New York where casino proponents are going for broke.

Related Companies and Wynn Resorts recently formed a partnership to pursue a gaming license at Hudson Yards in Manhattan, while SL Green Realty joined forces with Caesars Entertainment to build a casino in Times Square. At Willets Point, New York Mets owner Steve Cohen is also flouting his interest in getting a gaming license by starting a so-called visioning process for the 50 or so acres that surround Citi Field.

Yet even if Las Vegas Sands’ roll of the dice for a state casino license comes up snake eyes, the company claims it still plans on redeveloping the area. We shall have to see what it has in mind if that’s the case..

This is far from the first time that a developer has made lofty promises of transformative change at the Nassau Hub. Back in 2004 Charles B. Wang wanted to erect the 60-story Lighthouse Project there. It never got off the ground.

In 2018, RXR Realty and BSE Global breathed new life into the Hub’s dormant development by proposing a $1.5-billion project that called for 500 units of housing, 600,000 square feet of office- and biotech-research space, and 200,000 square feet of “experiential retail,” plus 3,400 parking spaces, rapid transit links to both the Mineola and Hempstead LIRR stations, as well as two new pedestrian bridges.

On May 22, 2019, the Memorial Sloan Kettering Cancer Center finally opened its proposed new $140 million facility, known as MSK Nassau, on a five-acre portion of the Hub site, but momentum to transform the region into a bio-tech wonderland has seemed to be on life support ever since.

In June 2020, it was even announced that the once-venerated venue where the Islanders won four straight Stanley Cup championships would be closing indefinitely due to the financial strains buffeting its then-owner. Fortunately, the shuttered venue quickly reopened later that summer, but it has been on thin ice ever since. The latest live events at the venue have been LI Nets Basketball, an NBA G-League team affiliated with the Brooklyn Nets with tickets as low as $20, and Hot Wheels Monster Trucks Live Glow Party.

For the Nassau Hub, all this is nothing new. Since the Coliseum’s renovation, its environs have been depressingly empty even as other developmental efforts have been kick-started across the region in recent years.

Now Las Vegas Sands has rolled in, with nearly limitless financial resources and a powerful army of lobbyists to get its message out. And Sands has dangled the prospect of tantalizing revenues before cash-starved Nassau County in order to hash out the terms so it can take over the Coliseum’s lease.

Pictured: Nassau residents watch the movie ‘Trolls’ at a drive-in movie arranged by Nassau County at the parking lot of NYCB’s LIVE at the Nassau Coliseum during the Coronavirus pandemic in May 2020 (Source: Bruce Bennett/Getty Images)

Scott Rechler, the chairman and CEO of RXR Realty who once strived to, in his words, “create a new dynamic live, work, play community in the heart of Long Island,” has dubbed the casino proposal “Long Island’s ‘Amazon moment,’ ” in reference to the failed attempt to bring the giant tech company’s headquarters to Long Island City in 2019.

“These opportunities don’t happen too often, so you don’t want to blow it,” Rechler told Newsday’s Candace Ferrette.

So, here we are: what once was touted to be the next epicenter of cutting-edge medical research to cure diseases like cancer and offer much-needed next generation housing to Nassau County, would instead become home to a luxury hotel and a gambling casino.

Perhaps we should ask ourselves if after years of inaction and indifference on the part of elected officials, this outcome is not only inevitable, but also the only one that policymakers think that Nassau County residents—and all Long Islanders—deserve.

Richard Murdocco is an award-winning columnist and adjunct professor in Stony Brook University’s public policy graduate program and School of Atmospheric and Marine Sciences. He regularly writes and speaks about Long Island’s real estate development issues. Follow him on Twitter @thefoggiestidea.

Spencer Rumsey contributed to the reporting and research of this piece.

A casino? Thousands of car parking spaces? Hotels?

It all spells traffic jams, water resource issues, attraction to criminals, light pollution, noise, and much more expense than profits, and profits for who anyway?

I’m sick of these selfish, so called “developers”. I call them undevelopers as they undevelop open spaces and natural views and future promise with expensive projects designed to pad the pockets of lobbyists and the rich while turning Nassau County into a crowded extension of Queens County.

As the article intimates, there are increasingly available alternatives for people to waste their money on gambling. As such we can expect investments in these monuments to cultural decay to become less profitable as they become more expensive to run.

What we should be considering is affordable housing (not sky high buildings on that score) in tasteful, tree filled communities designed for walking, playing and bicycling, all accessible via rationally conceived mass transit. We can add to that a variety of research centers (and this area is conveniently located next to colleges) and labs designing improvements to the health and welfare of life on our shrinking planet. And, if that isn’t acceptable, something along the same concept which is based on future investments in rational ideas that work to strengthen our world and community, not to cater to the worst in human impulses, all short sighted for the future and narrow visioned toward short range profits to the rich at the expense of people who are always taken advantage of.