The following reported piece was published in the 2017 July/August print and online edition of Long Island Pulse Magazine. You can read the original piece here.

Long Island’s luxury real estate market is currently favoring more modest abodes over mega-sized, mega-priced mansions—a trend that is following suit nationally. These changing dynamics are not necessarily a sign of market weakness, but instead a reflection of shifting seller/buyer preferences. The most recent data shows the Island is recovering from the depths of an unrelenting housing crunch and recession. At the same time, the East End luxury market has shown year-over-year gains in median prices and sales activity. But the numbers don’t tell the full story as the Hamptons have struggled to keep pace with the frenzied gains being made elsewhere in the region.

The Hamptons are trailing the region,” said Jonathan Miller, president and CEO of Manhattan-based Miller Samuel, the real estate appraisal and consulting firm that produces Douglas Elliman’s market reports. To Miller, the market’s strength can be found within the “Hamptons middle.” That is, properties with a price range between $1 and $5 million.

In western Suffolk and Nassau counties, median prices climbed 4 percent while market inventory plunged to the lowest point in 15 years. There is ample demand for single-family housing, but few sellers are ready to let go of their investment. Out East, listings continue to have elongated lifespans, a hallmark of the post-recession luxury market. This, paired with low inventory, has created an interesting market dynamic that showcases year-over-year pricing growth but overall stagnation.

From January to March, the Hamptons saw an 11 percent increase in median sales price and an 8 percent rise in sales activity compared to the same period last year. Judged against the rest of Long Island’s growth (a 4 percent rise in median sales price and 5 percent gain in sales), the Hamptons numbers look impressive. The Hamptons housing market was characterized by more sales and less inventory, with the continuation of the “soft at the top” theme and one interpretation could be that this is a product of sellers who are more willing to compromise with buyers after having their listings sit for upwards of 150 days on the luxury market.

Markets country-wide are seeing an overall downward trend in housing size, according to the National Association of Home Builders and the luxury market may face additional challenges in future months as a result. In regions elsewhere that have price points similar to that of the Hamptons, like Greenwich, entry-level to $2 million homes are selling quickly, but listings at a higher price point are treading water.

But the luxury market in the New York metro region isn’t exactly homogeneous. “Greenwich is mostly primary residences,” Miller said, noting that area of Connecticut competes with New York City for buyers in the upper price ranges. “The Hamptons primary market are secondary homes, [still] aggregate pricing of the Hamptons mirrors Manhattan. Both markets remain in sync and are influenced by Wall Street.”

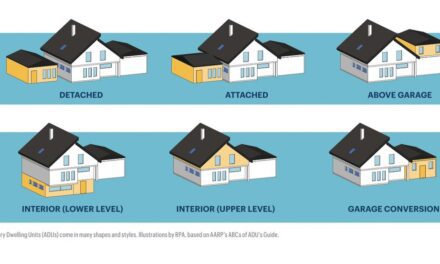

As the population of the East End swells during the summer months, the limitations of the twin forks become readily apparent. While two lane winding roads make for quaint living, they lose all of their practicality when they are swamped with tourists, gawkers and hedge fund managers—all of whom are trying to get to the same locations for different reasons. Much of the focus out East is always on the luxury sector, but policymakers in townships across the Peconic region are clamoring to find ways to build housing in the more moderate, sub-million dollar price ranges. In recent years, elected officials have tried the herculean task of expanding the area’s housing diversity and infrastructural capacity without disrupting some of the world’s most exclusive and storied properties.

The Hamptons market has all the makings of a unique real estate ecosystem. The area falls into the trappings of other luxury residential sub-markets, complete with cyclical ebbs and flows that are complex. Add to the mix restrictive land usages that keep the residential properties exclusive and you have ripe conditions for a region to continue to insulate itself from general market conditions. “All in all, the Hamptons markets are stable,” Miller said. “Things are not as bad as they could be, but not as good either. Right now, you don’t have the extremes we were seeing two to three years ago.”

“The East End will always be desirable because of the fact it is a destination as opposed to a primary market,” said Sheri Winter Clarry, an associate broker at the Corcoran Group, noting buyers and sellers should be prepared to act quickly. “Properly priced properties are getting a lot of activity and deals are getting done. Because there’s a definite lack of inventory, a buyer has to be ready to transact, especially if they find that one dream property. Sellers need to be prepared to negotiate swiftly.” Moderate, sub-million dollar price homes are the number one sellers on the North Fork, Clarry said. This, paired with Miller’s notion of the “Hamptons middle,” may be pointing to an eventual scaling back for the area as a whole.

Richard Murdocco regularly writes and speaks on Long Island’s real estate development issues. He is the founder and publisher of The Foggiest Idea, a public resource for land use in the New York metro region, and received his Master’s in Public Policy at Stony Brook University, where he studied regional planning under Dr. Lee Koppelman, Long Island’s veteran master planner. More of his views can be found on www.TheFoggiestIdea.org or follow him on Twitter @TheFoggiestIdea. You can email Murdocco at Rich@TheFoggiestIdea.org.